Advanced industrial processes in the petrochemical sector continue to demand specialty gases with higher levels of purity and more precise accuracies. An increasing number of specifications for these gases now go down to parts per billion (ppb) and sometimes even to parts per trillion (ppt).

What are specialty gases?

Specialty gases represent rare or ultra-high purity (99.995% and above). Many industries, including analytical, pharmaceutical, electronics, and petrochemical, benefit from specialty gases’ unique properties that help improve yields, optimize performance, and lower costs.

What are the different types of specialty gases?

According to their application fields, specialty gases can be divided into electronic, high-purity, and standard or calibration mixture gases.

• Electronic gases are used for various applications such as microelectronics, surface coatings, glasses, Fabre optics, etc.

• High Purity Gases can go up to 6.0 grades, Rare gases, Electronic & Semiconductor grades, Calibration standards, etc.

• Standard or calibration mixtures are a broad spectrum of types, grades, compositions, etc. Standard mixtures are commonly categorized as Binary (2 component) mixtures or Multicomponent, depending on the number of different kinds of gases homogenized with other molecules.

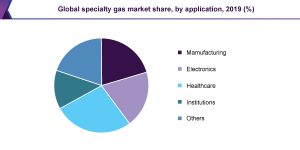

What is the market size of Specialty gases?

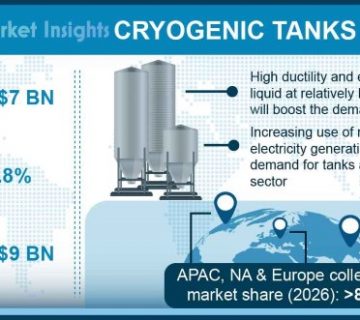

The global specialty gas market maintains a steady growth trend. The market size is expected to reach US$65.1 billion in 2020, of which the demand for specialty gases in the Asia-Pacific (A.P.) region will grow the fastest. The A.P. region’s market size is expected to reach US$16.8 billion in 2020, accounting for 25.80% of the global specialty gas consumption.

Who are the leading suppliers of Specialty gases?

The specialty gas industry has high barriers to entry, and the market presents an oligopoly pattern. The top companies in the sector are:

1. Air Liquide S.A.: Air Liquide S.A. is a specialty gases supplier in France and provides industrial gases, specialty gases, and solutions to various industries, including medical, chemical, and electronic manufacturers. The company’s revenue for F.Y. 2019 increased to EUR 21.92 billion from EUR 21.01 billion and was forecast to reach EUR 22.08 in F.Y. 2020.

2. Taiyo Nippon Sanso Corporation (TNSC): TNSC is an industrial gas manufacturer headquartered in Japan. Taiyo Nippon Sanso reliably supplies the required gases at the time needed through its optimized supply system. Taiyo Nippon Sanso also provides gas-related equipment, services, applications, etc. TNSC’s revenue on a consolidated basis increased 14.6% year on year to ¥740,341 million, core operating income rose 9.6% to ¥65,819 million, active income increased 11.7% to ¥66,863 million, and net income attributable to owners of the parent decreased by 15.6% to ¥41,291 million.

3. Linde plc: Linde, a UK-based chemical company, is the world’s largest industrial gas company by market share and revenue. The company also owns BOC Ltd, one of the largest specialty gas suppliers in the E.U. region. The company’s overall revenue 2019 was $28 billion (€25 billion).

4. Air Products and Chemicals, Inc.: Air Products is U.S. based MNC. The company serves customers globally with a unique portfolio of products, services, and solutions, including atmospheric gases, processes, specialty gases, equipment, and services. With operations in 51 countries outside the United States, in the fiscal year 2019, the company had sales of $8.9 billion.

5. Praxair, Inc. is the largest industrial gas company in North and South America and one of the largest worldwide, with 2011 sales of $11 billion. The company produces, sells, and distributes atmospheric, processed, and specialty gases.

6. BOC Group plc is one of the world’s largest producers of industrial gases essential to almost every manufacturing process. It supplies a variety of gases to the petroleum, electronic, steel manufacturing, metal producing and fabricating, construction, ceramic, and food and beverage industries. It’s principal related companies operate in over 60 countries across the globe.

7. Messer Group GmbH

Messer was founded in 1898 and is the largest family-run specialist for industrial, medical, and specialty gases worldwide. The brand ‘Messer – Gases for Life’ offers products and services in Europe, Asia, and the Americas. Messer Group acquired the majority of Linde AG’s’ gases business in North America and confident Linde and Praxair business activities in South America effective March 1, 2019, in a joint venture – called Messer Industries GmbH – with CVC Capital Partners Fund VII (“CVC”). Messer Industries invested around 3.6 billion U.S. dollars (3.2 billion euros). Messer Group (52 %) contributed most of its Western European companies to the joint venture.

8. BASF SE engages in the provision of chemical products. It operates through the following segments: Chemicals, Materials, Industrial Solutions, Surface Technologies, Nutrition and Care, and Agricultural Solutions. The Chemicals segment supplies petrochemicals and intermediates. The Materials segment includes isocyanates, polyamides, inorganic essential products, and specialties for the plastics and plastics processing industries.

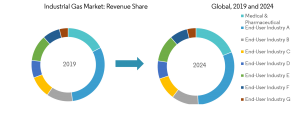

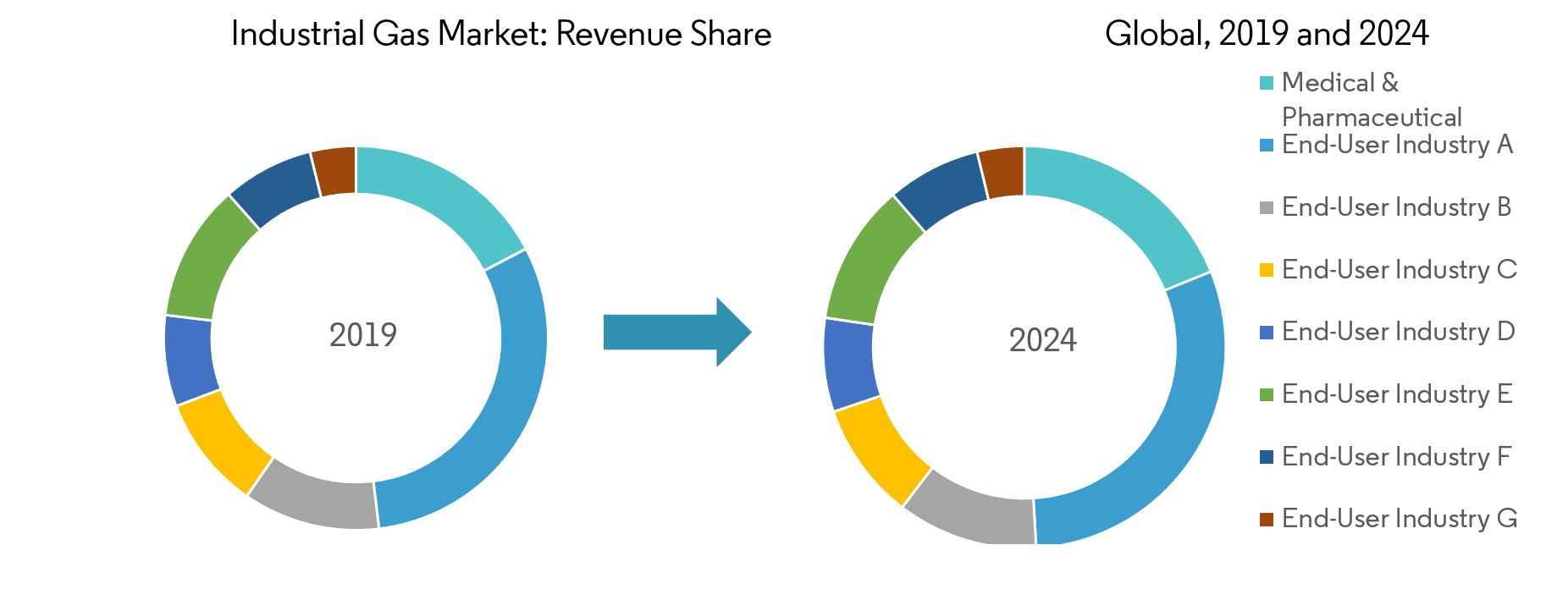

Industrial Gas Industry Segmentation

Industrial gases mainly comprise carbon dioxide, carbon monoxide, hydrogen, argon, nitrogen, oxygen, helium, and krypton-xenon. The atmospheric gases like oxygen, nitrogen, and argon are captured by reducing the air temperature until the components are liquified and separated. The industrial gas market is segmented by product type, end-user industry, and geography. The market is segmented by product type into nitrogen, oxygen, carbon dioxide, hydrogen, helium, argon, ammonia, methane, propane, butane, and other classes. The end-user industry segments the market into chemical processing and refining, electronics, food and beverage, oil and gas, metal manufacturing and fabrication, medical and pharmaceutical, automotive and transportation, energy and power, and other industries. The report also covers the market size and forecasts for the industrial gas market in 15 countries across major regions. The market sizing and projections are based on volume (kilotons) for each segment.

| Product Type | |||

| Nitrogen | |||

| Oxygen | |||

| Carbon dioxide | |||

| Hydrogen | |||

| Helium | |||

| Argon | |||

| Ammonia | |||

| Methane | |||

| Propane | |||

| Butane | |||

| Other Product Types (Fluorine and Nitrous oxide) | |||

| End-user Industry | |||

| Chemical Processing and Refining | |||

| Electronics | |||

| Food and Beverage | |||

| Oil and Gas | |||

| Metal Manufacturing and Fabrication | |||

| Medical and Pharmaceutical | |||

| Automotive and Transportation | |||

| Energy and Power | |||

| Other End-user Industries | |||

| Geography | |||

| Asia-Pacific | |||

| China | |||

| India | |||

| Japan | |||

| South Korea | |||

| ASEAN Countries | |||

| Rest of Asia-Pacific | |||

| North America | |||

| United States | |||

| Canada | |||

| Mexico | |||

| Europe | |||

| Germany | |||

| United Kingdom | |||

| France | |||

| Italy | |||

| NORDIC Countries | |||

| Rest of Europe | |||

| South America | |||

| Brazil | |||

| Argentina | |||

| Rest of South America | |||

| Middle-East and Africa | |||

| Saudi Arabia | |||

| South Africa | |||

| Rest of Middle-East and Africa |

DSW Industry is one of the leading manufacturer and distributor of gaseous chemicals and specialty gases in South East Asia. We strive to be the lowest-cost supplier to the market while meeting ever-stricter environmental and safety standards.

No comment